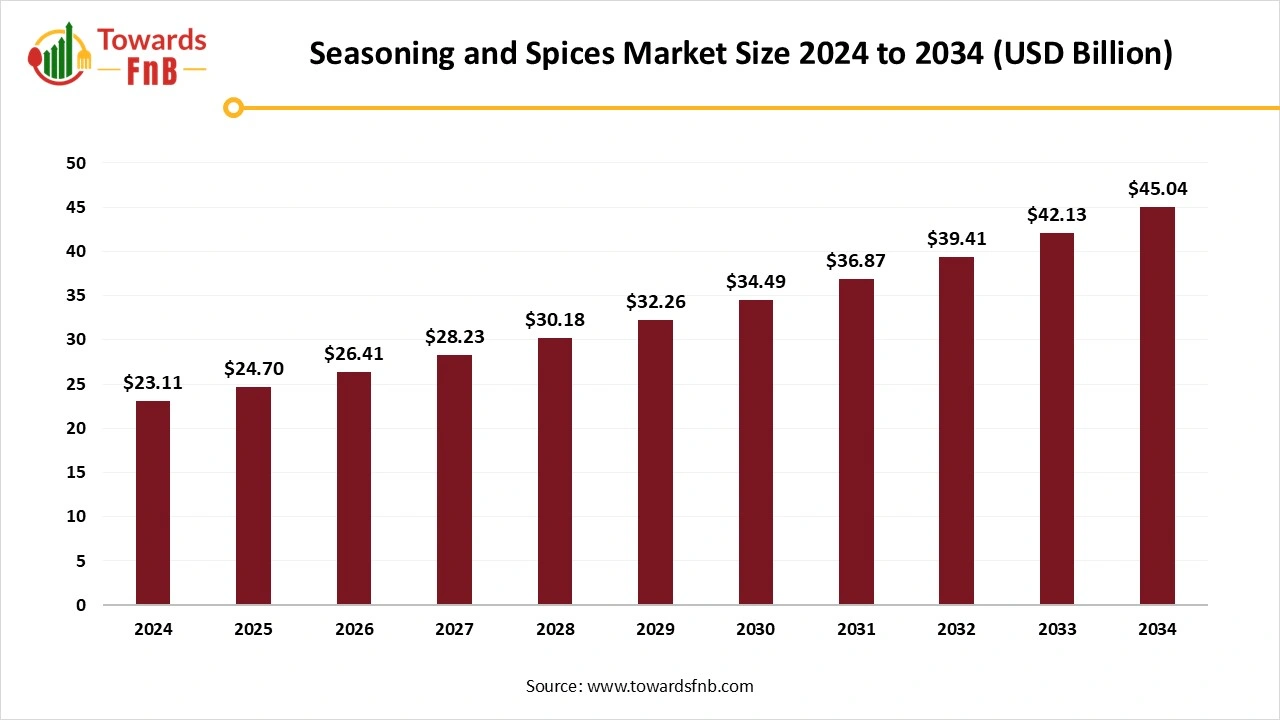

Spices and Seasonings Market Size Set to Reach USD 45.04 Billion by 2034, Driven by Globalization and Consumer Trends

According to Towards FnB, the global spices and seasonings market size is evaluated at USD 24.70 billion in 2025 and is projected to reach USD 45.04 billion by 2034, with a robust CAGR of 6.9% from 2025 to 2034. This growth is fueled by factors such as globalization, evolving consumer preferences for exotic flavors, and increased demand for convenience in cooking.

Ottawa, Oct. 14, 2025 (GLOBE NEWSWIRE) -- The global spices and seasonings market size was valued at USD 23.11 billion in 2024, with a notable upward trajectory expected as it grows from USD 24.70 billion in 2025 to nearly USD 45.04 billion by 2034. The market’s growth is further supported by expanding culinary diversity across regions and increasing consumer awareness of the health benefits of spices. Towards FnB, a sister firm of Precedence Research, highlights that emerging markets in Asia, Latin America, and parts of Africa are expected to drive significant growth in the coming years.

The recent surge in demand for spices and seasonings can be attributed to a growing global interest in experimenting with diverse cuisines. As consumers become more adventurous with their food choices, the market is benefiting from the increasing popularity of ethnic foods. Additionally, the health-conscious consumer is increasingly opting for spices with antioxidant and anti-inflammatory properties. These properties not only contribute to the health benefits of spices but also align with the rising demand for organic, non-GMO, and clean-label products. This shift towards more natural and functional ingredients is helping to fuel the spices and seasonings market's continued growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5515

Key Highlights of the Spices and Seasonings Market

• By region, Asia Pacific led the spices and seasonings market with the largest share of 79% in 2024, while Europe is expected to experience the fastest growth during the forecast period.

• By product, the spices segment dominated the market with the highest share of 64% in 2024, whereas the salt & salt substitutes segment is anticipated to grow at a CAGR of 7.8% during the forecast period.

• By brand, the national brands segment held the leading share of 88% in 2024, while the private label segment is expected to see the fastest growth in the coming years.

• By end use, the retail segment held the largest share of 80% in 2024, while the foodservice segment is forecasted to grow at the fastest rate during the forecast period.

Globalization: Helpful for the Growth of the Spices and Seasonings Industry

The spices and seasonings market is observed to grow due to factors such as higher demand for exotic flavors, convenient food options, and healthier natural ingredients. Globalization is one of the biggest factors for the growth of the spices and seasonings market. Consumers moving from one country to another and adapting the culture and food habits of the region help them to discover new forms of spices and seasonings, further fueling the growth of the market. Trying new cuisines from different cultures, with the help of the spices involved, is another major factor in the growth of the spices and seasonings market.

The health benefits of spices such as turmeric, garlic, cloves, cardamom, and other whole spices are another major factor in the growth of the market. They help boost immunity and are also useful for various home remedies commonly observed in Asian countries, which is another major factor in the market's growth. High demand for ethnic food options further fuels the need for innovative spices, which also aid the growth of the spices and seasonings market. The use of spices in various food options, such as salads, staple foods, and even beverages, to enhance their taste, is also boosting the demand for spices. Restaurants, cafes, and household segments also help to enhance the growth of the market.

New Trends of Spices and Seasonings Market

- High demand for organic, functional, and natural spices and seasonings is one of the major growth drivers for the spices and seasonings market. They help enhance immunity and further induce market growth.

- Globalization, leading to consumers trying different cuisines from around the globe, is another major factor for the growth of the market. Trying cuisines of different cultures also leads to demand for different types of spices, further fueling the growth of the market.

- High demand for various spices, whole spices, marinades, rubs, and herbs for preparing different food items is another major growth driver of the market.

- Sustainable practices followed for spice extraction are another major factor that helps fuel the growth of the market.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/spices-and-seasonings-market

Impact of AI in the Spices and Seasonings Market

AI is increasingly becoming a powerful enabler in the spices and seasonings market, bringing enhancements in quality control, product innovation, supply chain optimization, and fraud detection. In processing, computer vision and spectral-analysis systems powered by AI can inspect raw spice inputs (e.g., chilies, turmeric, pepper) in real time, classifying them based on color, texture, moisture, and degree of ripeness or damage, thereby reducing manual sorting effort and improving consistency. For example, some firms use AI models to distinguish “good” chilies from substandard ones at the edge, boosting throughput and reducing errors. Simultaneously, AI helps detect adulteration or substitution, a major challenge in spices, by analyzing chemical and spectral fingerprints and flagging anomalies that deviate from expected profiles.

Recent Developments in the Spices and Seasonings Market

- In August 2025, the Andaman and Nicobar administration launched an ambitious project titled ‘Spice Pravah’ to revitalize the centuries-old spice route to boost production. The region provides a wide variety of spices due to 3,400 mm annual rainfall spread across 180 days, with a climate conducive to spice production. (Source- https://www.awazthevoice.in)

- In June 2025, Indian Union Home Minister, Mr. Amit Shah, inaugurated the headquarters of the National Turmeric Board in Nizamabad, Telangana. Being the 3rd largest turmeric producer, Telangana was the ideal choice for the formation of the National Turmeric Board. (Source- https://www.downtoearth.org.in)

Spice Import Data in 2024-25

| Country | Spice Import (in millions of dollars) |

| USA | 466.08 |

| Saudi Arabia | 295.29 |

| Netherlands | 253.03 |

| Germany | 232.26 |

| United Arab Emirates | 186.75 |

| Bangladesh | 165.68 |

| United Kingdom | 163.17 |

| Japan | 151.61 |

| Spain | 120.86 |

| France | 118.96 |

(Source- https://www.tradeimex.in/blogs/top-spice-importers-global-spice-imports-data-2025)

The table above reflects the top 10 spice-importing countries globally in 2024-25. The US, Saudi Arabia, and the Netherlands play a major role in the growth and shaping of the spices and seasonings market, as their higher demands help to shape the industry. Their demand helps manufacturers understand the increased demand for certain spices and study the trend accordingly. The US, as the highest importer of spices in 2024-25, reflects a diverse culinary landscape and multicultural population, which drives the demand for various spices and seasonings.

Black pepper, turmeric, and cumin seeds are among the most demanded and imported spices in the US. Saudi Arabia, as the 7.3% holder of global spice importers, ranks second highest due to factors such as the powerful culinary traditions followed in the region. Cardamom, black pepper, and saffron are some of the highest demanded and imported spices in the region, helping to fuel the growth of the spices and seasonings market.

Trade Analysis of Spices and Seasonings Market: Import and Export Statistics

The global spices and seasonings market has experienced consistent growth in recent years, driven by rising consumer demand for natural flavor enhancers, ethnic cuisine trends, and clean-label seasonings. Increasing processed food consumption and health-focused reformulations have also boosted international spice trade volumes.

Top exporters in the Spices and Seasonings Market

- India is the world’s largest exporter of spices, accounting for approximately US$4.72 billion in export value during FY 2024–25. India dominates global trade in chili, turmeric, cumin, coriander, and spice oils/oleoresins. Strong domestic production, quality assurance systems, and advanced processing capabilities enable Indian exporters to serve over 180 countries.

- Vietnam ranks second globally, led by its position as the world’s largest producer and exporter of pepper. In 2024, Vietnam exported 250,600 tonnes of pepper valued at around US$1.3 billion, with export growth supported by rising global prices and efficiency gains under the EU–Vietnam Free Trade Agreement (EVFTA).

- China is a major exporter of garlic, ginger, and other seasoning ingredients. In 2023, China exported approximately 2.03 million tonnes of garlic valued at US$2.37 billion, making it the world’s top supplier of this key seasoning. Competitive pricing, large-scale farming, and processing infrastructure underpin its export strength.

- Sri Lanka continues to lead the export market for true cinnamon (Cinnamomum verum), accounting for over 80% of global supply. In 2023, cinnamon exports were valued at about US$211 million, supported by strong demand in the EU and North America for premium-grade natural flavoring.

- Indonesia holds a strong position as a key exporter of nutmeg, cloves, and white pepper, serving as a primary supplier to the U.S., the Middle East, and Europe. Its extensive spice cultivation base and favorable trade ties make it a consistent global contributor.

- The Netherlands serves as a European re-export hub for spices and seasonings. While not a major producer, it imports large quantities from Asia (especially India and Vietnam), processes or packages them, and redistributes across the EU under established logistics and quality systems.

Country / Regional Highlights and Trade Flows

-

India to Global Markets

India’s export network spans over 180 countries, with the U.S., China, Bangladesh, and the UAE among its top destinations. Chili and spice oils remain leading export categories, supported by advanced processing and certification standards from the Spices Board of India. -

Vietnam's relations with the EU and the U.S.

Vietnam’s pepper exports reached record highs in 2024, benefiting from tariff reductions under the EVFTA and steady demand from Western markets. The country continues to dominate the global pepper trade with over 40% market share. -

China’s Garlic and Ginger Dominance

China’s garlic exports, valued at US$2.37 billion in 2023, continue to rise due to strong supply chains and year-round availability. The country remains the go-to supplier for seasoning manufacturers worldwide. -

Sri Lanka and Indonesia’s Specialty Advantage

Sri Lanka’s true cinnamon and Indonesia’s nutmeg and cloves cater to the premium and natural segment of the seasoning market, enjoying consistent demand growth from health-conscious consumers in Europe and North America.

Value Chain Analysis in the Spices and Seasonings Market

1. Raw Material Procurement (Farms, Plantations, etc.)

Spices are sourced from smallholder farms and cooperatives across tropical regions (e.g., India, Indonesia, Vietnam). Procurement depends on crop yield, weather, and post-harvest handling, which influence volatile prices and quality. Buyers prioritize origin traceability, organic certification, and fair-trade sourcing as consumers seek purity and ethical production. Challenges include adulteration risks, fragmented supply chains, and fluctuating moisture content that affects storage and processing costs.

2. Processing and Preservation

Processing involves cleaning, drying, grading, grinding, blending, and sterilization to ensure food safety and consistent flavor. Technologies such as steam sterilization, cryogenic grinding, and dehydration preserve volatile oils and extend shelf life. Value addition occurs through custom spice blends, seasoning mixes, and functional formulations tailored for ready-to-eat or HoReCa segments. Efficient processing reduces microbial load and flavor loss, while automation and quality control enhance export competitiveness.

3. Packaging and Branding

Packaging protects aroma, color, and potency, often using multilayer barrier pouches, jars, or sachets with moisture and light resistance. Clear labeling of origin, purity, and “no artificial additives” builds consumer trust. Branding emphasizes authenticity (e.g., regional origins like Malabar pepper, Kashmiri chili) and health aspects (low sodium, natural). Premium and sustainable packaging, along with strong storytelling, drive differentiation, though it raises material and logistics costs in competitive retail environments.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5515

Spices and Seasonings Market Dynamics

What Are the Growth Drivers of the Spices and Seasonings Market?

The availability of convenient food options, ready-to-prepare meal kits, and premixed spice kits is a major factor in the growth of the spices and seasonings market. Such options are ideal and convenient for consumers with a hectic lifestyle. It helps them prepare different types of cuisines in less time and make marinades for various dishes with ease. Globalization, which leads consumers to try cuisines from around the world along with their authentic spices, is also a major factor in the growth of the spices and seasonings market. Health-beneficial properties and usefulness for different types of home remedies in Asia regions also aid the growth of the market.

Challenge

How Might Spice Adulteration Hamper Market Growth?

One of the major restrictions in the growth of the spices and seasonings market is due to spice adulteration. The presence of high levels of sodium, allergens, preservatives, pesticides, heavy metals, agricultural chemicals, and synthetic fertilizers in spices can lead to major health and mental issues, which in turn disturb the growth of the spices and seasonings market. Issues in the authenticity of spices and spice blends also hamper and restrain the growth of the market.

Opportunity

How Are Technological Advancements Accelerating Market Growth?

Encapsulation technology helps protect the bioactive compounds of spices, which are prone to breaking down due to heat, light, oxygen, temperature, pH, and moisture, thereby restricting their chemical use. Such factors help the growth of the spices and seasonings market in the foreseeable period. The technological advancements help to emulsify the spices and encase them in appropriate coatings for internal and external protection.

Spices and Seasonings Market Regional Analysis

Why Did the Asia Pacific Region Lead the Spices and Seasonings Market in 2024?

Asia Pacific dominated the spices and seasonings market in 2024, as the region is considered the biggest spice exporter and producer in the world. Countries such as India, China, and Vietnam play a vital role in the growth of the market in the region. Globalization, which leads to higher demand for spices and seasonings from around the globe for different types of cuisines, also helps the growth of the market.

Organic spice farming, especially for the cultivation of traditional spices, also leads the market. India, being the largest spice producer globally, produces around 75 to 109 types of spices recognized by the International Organization for Standardization. Hence, the country plays a massive role in the growth of the region's market.

Why Is Europe Expected to Be the Fastest-Growing Region During the Foreseen Period?

Changing consumer tastes and preferences, along with increased demand for convenient food options and premium, organic, and traditional spices, are some of the major reasons for the growth of the spices and seasonings market in the foreseeable period. The consumers of the region also prefer to experiment with cuisines and try different tastes from around the globe, further fueling the demand for different types of spices. Hence, the region has a major role in the growth of the market in the foreseeable period.

Spices and Seasonings Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 6.9% |

| Market Size in 2025 | USD 24.70 Billion |

| Market Size in 2026 | USD 26.41 Billion |

| Market Size by 2034 | USD 45.04 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Spices and Seasonings Market Segmental Analysis

Product Analysis

The spices segment led the spices and seasonings market in 2024 due to higher demand for diverse tastes, cuisines, foods, and snack options. Spices and pre-spice mixes are essential for consumers with hectic lifestyles, as they help save time and prepare nutritious and unique cuisines quickly, further supporting the growth of the spices and seasonings market.

The salt and salt substitutes segment is expected to grow in the foreseeable period due to consumer awareness regarding the health risks associated with higher sodium consumption. Government regulatory standards for higher sodium consumption also help to educate consumers about the right amount of consumption. Higher sodium consumption may result in different cardiovascular issues and hypertension. Hence, the segment has a major role in the growth of the market in the foreseeable period.

Brand Analysis

The National brands segment led the spices and seasonings market in 2024 due to innovative tactics and schemes, further fueling market growth. Availability of classic and innovative spices by such brands is another major factor fueling the growth of the spices and seasonings market. Ethical sourcing and manufacturing of spices by National brands help the industry grow and set an international example for purity.

The private segment is expected to grow in the foreseen period due to the availability of diverse spices and seasonings by such brands. They help enhance the flavor of various cuisines and are essential for preparing dishes from around the world. Such brands also have strategic schemes and plans to maintain their position in the competitive market, further fueling the growth of the spices and seasonings market in the foreseeable period.

End User Analysis

The retail segment dominated the spices and seasonings market in 2024, focusing on activities such as spice processing, grinding, packaging in various containers, and selling them in retail outlets under their own brands or private labels. Consumers can shop for different types of spices and seasonings from such retail outlets, further fueling the growth of the market.

The food service segment is expected to grow in the foreseeable period due to high demand for dining in various restaurants and cafes or ordering food from different foodservice facilities. Such places have cuisines from around the world, further inducing the growth of the market in the foreseeable period. The availability of various cuisines cooked with different spices on online platforms further supports the growth of the market in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Personalized Nutrition Market: The global personalized nutrition market size is forecasted to expand from USD 17.92 billion in 2025 to USD 61.56 billion by 2034, growing at a CAGR of 14.7% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Fresh Produce Market: The global fresh produce market size is projected to grow from USD 3,707 billion in 2025 to approximately USD 5,653 billion by 2034. This anticipated growth represents a CAGR of 4.80% during the forecast period from 2025 to 2034.

-

Frozen Meat Market: The global frozen meat market size is expected to grow from USD 97.58 billion in 2025 to USD 129.56 billion by 2034, at a CAGR of 3.2% over the forecast period from 2025 to 2034.

Top Companies in the Spices and Seasonings Market

- Everest Spices: One of India’s largest spice brands, Everest offers a wide range of blended and pure spices known for quality, consistency, and authentic flavor profiles.

- McCormick & Company: A global leader in spices, seasonings, and flavorings, McCormick provides premium blends and culinary solutions for retail and foodservice industries worldwide.

- Olam International: A major player in spice sourcing and processing, Olam manages a vertically integrated supply chain for high-quality spices and herbs, emphasizing traceability and sustainability.

- DÖHler GmbH: Specializes in natural ingredients, including spice extracts and flavor systems, offering customized taste solutions for global food and beverage manufacturers.

- Patanjali Ayurved Limited: Produces a variety of natural and ayurvedic spice blends, combining traditional Indian recipes with health-focused formulations.

- Badshah Masala Private Limited: Known for its authentic Indian spice blends, Badshah offers regional masalas and seasoning mixes catering to diverse culinary traditions.

- Catch: A leading Indian spice brand recognized for hygienically packaged pure and blended spices, serving both household and professional culinary markets.

- Kerry Group PLC: Provides flavor and seasoning systems for global food manufacturers, integrating natural spices with cutting-edge taste and nutrition technologies.

- MTR Foods: Offers a mix of ready-to-use spice blends, pastes, and traditional masalas, catering to convenience-oriented consumers seeking authentic Indian flavors.

- Sensient Technologies Corporation: Develops natural flavoring and spice extracts for processed foods, focusing on color, aroma, and clean-label ingredient solutions.

- Ajinomoto Co.: Renowned for its umami-based seasonings and flavor enhancers, Ajinomoto combines culinary science with health-oriented spice and condiment innovations.

- Frontier Co-op: A U.S.-based cooperative offering organic, fair-trade spices and herbs, promoting ethical sourcing and sustainability in the natural food market.

- Zoff Spices: An emerging Indian spice brand known for its zip-lock packaging technology and focus on freshness, aroma retention, and consumer convenience.

- Adani Spices: Manufactures a diverse range of spice powders and blends, emphasizing premium quality and expanding distribution in domestic and export markets.

- Associated British Foods: Through its AB World Foods division, it offers branded seasoning products and spice-based sauces, including Patak’s and Blue Dragon.

- Goldiee Group: A well-established Indian spice manufacturer producing traditional masalas and blends that reflect regional culinary diversity.

- Organic Spices Inc.: A leading U.S. producer of certified organic and non-GMO spices, offering private-label and bulk spice solutions to retailers and manufacturers.

- Rajesh Masala: Specializes in affordable, high-quality blended spices with a strong presence in India’s mass-market and regional spice categories.

- Ajy Global Trade: An international exporter of Indian spices and condiments, focusing on natural sourcing and compliance with global food safety standards.

- Ariake Japan: Produces natural seasonings, spice extracts, and bouillons derived from meat, vegetables, and herbs, focusing on umami-rich culinary applications.

- Ashok Masale: Offers traditional Indian spice powders and blended masalas with a strong presence in northern India’s household and foodservice segments.

- Baron Spices Inc.: A U.S.-based custom seasoning manufacturer providing tailored spice blends and rubs for food processors and restaurants.

- MDH: One of India’s most iconic spice brands, MDH manufactures a vast portfolio of pure and blended masalas with a strong legacy in traditional Indian cooking.

- Everest Food Products Pvt. Ltd: Operates under the Everest brand, producing a wide variety of pure and blended spices exported to over 60 countries worldwide.

Segments Covered in the Report

By Product

- Spices

- Pepper

- Ginger

- Cinnamon

- Cumin

- Turmeric

- Coriander

- Cardamom

- Cloves

- Others

- Herbs

- Garlic

- Oregano

- Mint

- Parsley

- Rosemary

- Fennel

- Others

- Salt & Salts Substitutes

By Brand

- National Brand

- Private Label Brand

By End Use

- Retail

- Foodservice

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5515

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse |

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Organic Food Market: https://www.towardsfnb.com/insights/organic-food-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Dietary Supplements Market: https://www.towardsfnb.com/insights/dietary-supplements-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.